The New Ecommerce Growth Playbook: Scale Your Shopify Store to 8 Figures, 9 Figures & Beyond?

The playbook of converting more traffic to drive revenue for business growth is flawed. Too many businesses focus on this as their primary strategy expecting sustainable growth but are shocked when the results don’t support their efforts. Sure, you can spend more on acquisition and grow revenue but at what cost?

Traditional retailers whose sales have shifted to ecommerce during Covid-19 have been able to measure the impact online sales have had alongside their physical retail operations, and it’s not a great picture.

Forecasts suggest online sales could account for nearly half of all retail revenues by 2024.However, the results are not all positive. Our analysis of total shareholder returns (TSR) for 100 large retailers found digital growth alone does not necessarily lead to positive outcomes. In fact, the retailers with the most growth in online sales saw the biggest decline in margin (and thus TSR).

McKinsey & Company

In this article, I’ll demonstrate why the old ecommerce growth playbook no longer serves Shopify businesses that aspire to scale profitably and share an updated playbook for sustainable ecommerce growth.

I’ll cover

- An analysis of the ecommerce climate and how changes in the industry are making the old growth strategy risky,

- The guiding principles of the new ecommerce growth strategy, and

- A step-by-step guide on how to implement the new strategy.

Why converting more traffic = more revenue is a flawed growth strategy

Everyone and their dog has advice on how you should grow your business. Take this post on Reddit; Scaling from 6 to 7 figures. The post details how Shopify businesses should focus on optimizing their emails to drive this level of growth.

The problem is that just because it worked for one business does not mean it will work for another. There are too many variables and nuances involved.

However, what can apply globally to all businesses is a framework that helps owners discover their specific growth levers and apply experimentation to discover what works for them. Jon Ivanco, Co-Founder at Formtoro, illustrates this point wonderfully.

There’s another issue with much of the existing advice online. Most of it focuses on acquisition and driving revenue. I’m not disputing that growth demands a healthy traffic pipeline with the ability to turn visitors into customers. But the devil is in the detail.

The business world has long championed growth at any cost. The internet is littered with pitch decks and case studies with graphics of “hockey stick revenue” and “exponential growth.” Such stories have led many to try to replicate the revenue trajectories of these growth wonder brands.

There’s just one problem. Many companies who pursue a revenue growth strategy at any cost aren’t profitable. While unprofitable companies can become profitable given time, these tend to be the exception rather than the rule.

The playbook to peruse revenue over profit can be necessary in certain situations;

- To capitalize on a first-mover advantage or when launching into new markets.

- To secure a significant market share and kill off competition (think Amazon).

- When reinvesting heavily into your company.

But it’s a fine line between growth and business failure when chasing revenue over profit which requires careful financial management and, often, external investment to extend the cash runway.

While Stitch Fix has high revenue growth, its profitability had been poor with a 5-year average net margin of 0.32%.

One of the factors is due to the relatively high Selling, General, and Administrative Expenses (SG&A) expenses in % of its revenue…SG&A expenses for managing online orders and returns, digital marketing and supply chain improvements.

We expect Stitch Fix to continue incurring high expenses in order to maintain its competitiveness and market share. We believe this highlights a disadvantage as the company’s growth had been dependent on client acquisition rather than through the increasing monetization of its existing client base. Should its client base growth slow down, we believe this could be a risk to its overall growth should it fail to increase its client base monetization abilities.

Source

Ultimately, all businesses need to turn a profit. Those who have failed to develop a sustainable business model might find it impossible.

Many ecommerce businesses are struggling to make a profit in the current climate, making it imperative for a change in growth strategy. Here are some of the main factors impacting the old playbook.

Increasing customer acquisition costs

CommerceNext surveyed digital marketers at top retailers to determine where they invested their marketing acquisition dollars. The top two methods were paid social (78%) and paid search (69%). These channel choices are interesting, considering almost three-quarters of respondents from the same survey said they saw a declining performance of paid social after the iOS 14/15 privacy changes.

The Wall Street Journal put the increasing costs of ads into perspective; Plum Deluxe, a loose tea business, used to pay $27 to acquire a new customer via Facebook and Instagram ads.

Now that cost is ten times higher.

Outside of the implementation of iOS 14/15, other privacy-related changes involving the ban of third-party cookies will continue to impact the costs and performance of paid advertising channels.

Continuing to invest in paid acquisition channels as expenses rise and performance declines means cutting into your profit margins. These acquisition strategies are not sustainable and will reach a point where they can’t return a positive ROI.

Shipping, returns & supply chains

Ecommerce businesses contend with inflation, rising shipping costs, supply chain unreliability, petrol hikes, and worker shortages. These volatilities all impact the costs involved in running a business. Simplifying following the “acquiring more traffic and converting it” practice without adjusting other elements of your operations could see you trading at a loss on every sale you make.

Nike, for example, saw its digital sales soar by 75%, representing 30% of its total revenue. But expenses for shipping and returns also put more pressure on the company’s profits. Nike’s margins during its fourth quarter of 2020 shrank to 37.3% from 45.5% in 2019.

Focusing on the wrong metrics

A focus on conversion rates and revenue limits the scope for testing teams.

In the past, this has led some companies to harm their overall profitability.

For example, if you push your free returns policy, you’ll likely increase conversion rates and basket size (revenue). But unless you are tracking the impact (and cost) of this change across the wider business, increased returns might be costing you more than the transaction itself. Thus it’s essential to have guardrail metrics to ensure your changes are positive overall.

Guardrail Metrics are ones that are important to the company as a whole. While a feature does not necessarily need to improve a Guardrail Metric to be considered successful, all launches are meant to avoid having substantial negative impact on the guardrails.

Tatiana Xifara, Senior Data Scientist, Experimentation at Airbnb.

For more on this topic, check out the guardrail framework Airbnb implemented.

One final issue around the old growth playbook (or perhaps why it’s pursued by so many) is that revenue and conversions are more accessible metrics compared to profit.

Not only this, but qualitative research in which ten ecommerce leaders at large multinational brands with annual revenues over $250 million were interviewed, found that, the definition of profitability isn’t well defined or consistently measured.

Some companies define profitability with contribution margin. Others have less forgiving metrics like Net Income From Operations (NIFO). And then within those companies, different departments have different profitability goals. One respondent remarked, “Internally, we’ve got salespeople that are commissioned on gross sales. We’ve got marketing people and e-commerce people bonused on EBIT (earnings before interest and taxes). So, as you can imagine, the conversations between the two groups don’t get any better over time.

Forbes

Companies are shooting in the dark if they don’t provide teams across the business with a clear understanding of how their work impacts profit.

The new ecommerce growth playbook

Profit driving growth levers + repeatable & continuous testing process = sustainable and scalable growth.

Here’s a breakdown of each guiding principle that forms this new growth playbook.

Profit driving growth levers

The old playbook focused on a vanity metric (revenue) that orientated subsequent strategies around short-term thinking. Given the changes in the market when it comes to customer acquisition costs, shipping, and supply chains, this focus leads to unsustainable growth.

The new playbook focuses on identifying a range of levers that lead to long-term profit, not short-term revenue, a seemingly small but critical difference.

Experimentation

Some people feel the experimentation mindset limits innovation, but in reality, the limiting factor tends to be business culture. Innovation and experimentation go hand-in-hand. Radical innovations might go against conventional wisdom, so risk-controlled experiments can help validate ideas that might have otherwise been discounted.

For example, you might identify that certain clothing lines have a very slim margin, but there’s little room to optimize costs or increase prices. You could ditch the underperforming product line or experiment with innovative ideas.

PYMNTS research found that 61 million Americans use at least one subscription retail service. Could a different business model offering a clothing rental subscription change your growth trajectory?

Repeatable & continuous testing process

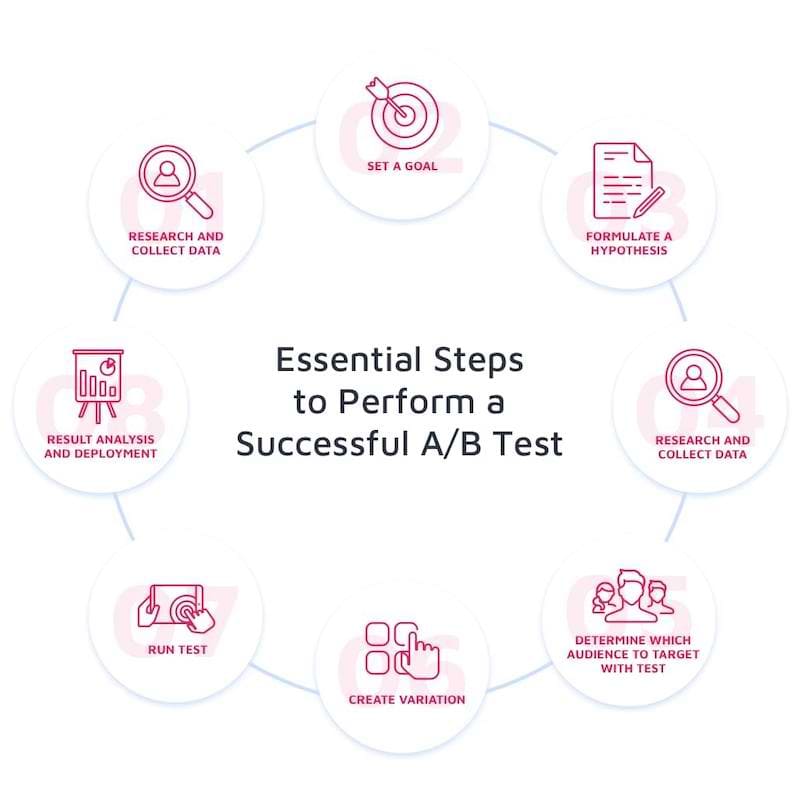

The final part of this new ecommerce growth playbook is a repeatable and ongoing testing process:

There are likely hundreds of ways you could impact your growth levers and millions of variations in terms of creative execution. Not all of your ideas will be successful. Some might even harm business. This is why a reliable and repeatable process to test and measure your ideas drives growth as you can focus on implementing the ideas that work for your business.

Here’s a real-life example of test results going against best practices:

When Petco executives investigated new pricing for a product sold by weight, the results were unequivocal. By far, the best price was for a quarter pound of the product, and that price was for an amount that ended in $.25. That result went sharply against the grain of conventional wisdom, which typically calls for prices ending in 9, such as $4.99 or $2.49. “This broke a rule in retailing that you can’t have an ‘ugly’ price,” notes Rhoades. At first, executives at Petco were skeptical of the results, but because the experiment had been conducted so rigorously, they eventually were willing to give the new pricing a try. A targeted rollout confirmed the results, leading to a sales jump of more than 24% after six months.

Harvard Business Review

A step-by-step guide to actioning the new ecommerce growth strategy

Step one: identify your growth levers

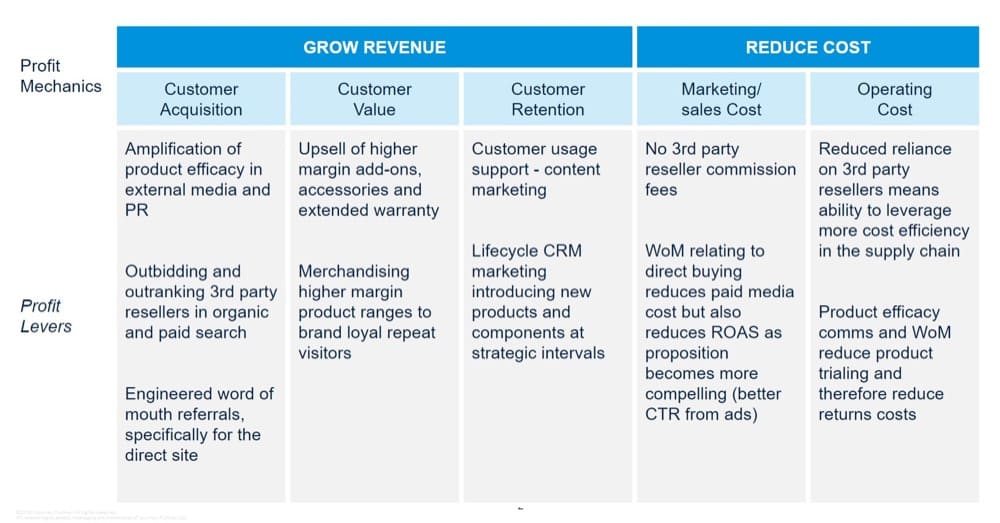

Effectively impacting profit boils down to optimizing revenue and reducing costs. While this formula might be true of all businesses, there are hundreds of permutations of the strategy itself.

One framework you can use to identify your growth levers is the Ecommerce Performance Framework, which breaks down the categories for investigation broadly into; customer acquisition, customer value, customer retention, marketing & sales costs, and operating costs.

You can use the Ecommerce Performance Framework (EPF) and format to collate your growth lever insights into a cohesive one-pager. Jonny Longden, Conversion Director at Journey Further provides some great guidance on how to use the EPF.

For most eCommerce businesses the broad framework will be roughly similar, however, it is very important you build this from the ground up and not just copy another model.

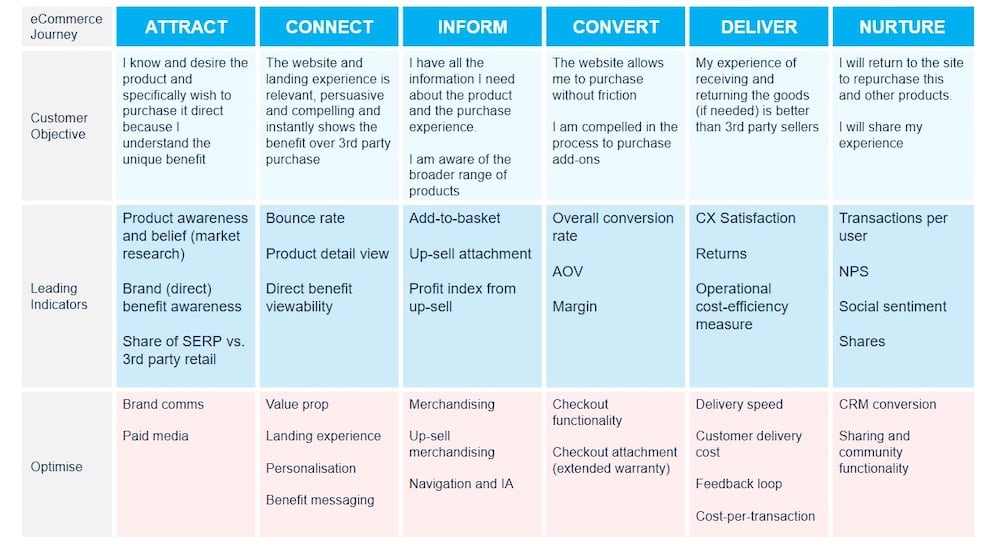

The primary aim is to identify the customer-centric goals. In our articulation of the strategy and profit mechanics above, we have identified that acquisition relies specifically on: customer understanding of the product and direct-buying benefits; the ability to outrank 3rd party sellers in search; and encouraged/engineered word of mouth.

Therefore the customer objective in the Attract phase is stated as: ‘I know and desire the product and specifically wish to purchase it direct because I understand the unique benefit’

One of the customer objectives in the Nurture phase is: ‘I will share my experience’

The point of this is;

a) to serve as a constant reminder of what exactly it is you need to measure and assess from the data i.e. what performance actually means in relation to your strategy.

And b) to help you identify meaningful metrics.

Without going through this process, there is a good chance that paid media would be run by ROAS or other standard metrics without necessarily considering the fact that it specifically needs to work against specific 3rd party resellers for an overall reduction in wider CPA.

Below I’ve listed the board categories used in the Ecommerce Performance Framework to provide some questions you can ask to identify growth levers for profitability within your business:

Questions to identity customer acquisition growth levers

- Who are your customers? Are they a profitable target for your business?

- Which customer segment is least profitable?

- Which marketing channels result in the highest profitability?

- How can you differentiate your brand from your competitors?

- Which marketing messages or USPs are perceived to add the most?

- Are there products your customer base (or a new segment) wants that you don’t currently offer?

- Does loss leader pricing bring in enough organic customers to support this strategy?

- What is the profitability of customers who purchase via different sales channels?

Questions to identity customer value growth levers

- Where are the biggest conversion opportunities throughout your customer journey?

- What is your customer’s brand perception, and how does price impact this?

- What’s the highest price customers are willing to pay for different products?

- What impact do sales promotions or discounts have on revenue and profit?

- How does bundled pricing compare to individual product sales?

- Which products or categories have the highest and lowest margin? What percentage of your sales are made up of each of these products?

- Are there products that are often purchased together which you don’t stock? E.g., batteries with kid’s toys. What impact would stocking these additional products have on average order value?

- What markets or geographies generate the highest profit?

Questions to identity customer retention growth lever

- Are there common characteristics or behaviors seen among your highest lifetime value customers?

- Which products have the best and worst customer reviews and why?

- Does your packaging add value to your brand perception? E.g., things as simple as including a free sample or kooky package design can act as a mechanism for increasing word-of-mouth marketing and repeat purchases.

- What’s the most effective marketing channel/creative/promotion to re-engage lapsed customers?

- What impact do loyalty schemes have on retention and profitability?

Questions to identity cost optimization growth levers

- Which products in your portfolio are hardest to sell, take up the most room in your warehouse or have the highest return rates? What impact does this have on your margins?

- What’s the cost impact of different payment terms or using various payment providers?

- What are the costs involved with your fulfillment methods and returns? How could you optimize these to increase profitability while growing revenue?

- What are the costs involved in different options for customers to collect and return items?

- What are the costs associated with various customer service options for dealing with complaints?

- Where are there efficiencies to be had in your marketing?

- Is your packaging optimized for storage and shipping to incur the smallest costs while delivering items undamaged?

The output

The above list should inspire you to uncover your business’s growth levers that impact profit. To support your efforts, you’ll need access to data (depending on what element you are investigating) and potentially some market research or customer insights to inform your assessment and understand the scale of each lever.

The ideal output from this exercise would be

- A list of pivotal growth levers throughout the customer journey which impact your profitability

- Benchmarks – the current performance of growth levers

- Leading Indicators – what are the key metrics around your growth levers?

- A customer-centric view of why the growth lever is important framed from a customer’s perspective.

- Targets – what’s the target you want to reach for each growth levers?

Step two: Use research & analysis to develop hypotheses for testing

You should know which elements of your Shopify store have the most significant impact on profitability. But as already mentioned, there are hundreds of strategies and thousands of ways to impact each. For example, you might identify increasing customer retention as a growth lever.

You could:

- Implement a new loyalty program

- Build an online community

- Offer a discount to previous customers

- Offer a personalized 1-1 product call to help new customers use your product.

These are just a few examples, each having thousands of permutations in terms of how you execute them.

So, where do you start?

By conducting user research and data analysis. Here are some handy, out-of-the-box reports for Shopify store owners to get you started.

User research and data analysis should be used to form your hypothesis for testing. Use it to identify what resonates with your customers and inform what issues or apprehensions they have concerning your growth levers. For example, you might conduct user interviews or analyze online reviews to identify issues impacting repeat purchases. You might discover a high proportion of customers mention issues around understanding how to use their new purchase and so stop using it. In this scenario, you might hypothesize:

If we increase customer understanding of product features, then repeat purchases will increase, because 67% of customer reviews online mentioned difficulty using our products and thus stopped using them.

Once you have your hypothesis, you can use the data you used to form them to help you objectively prioritize them. There is a range of prioritization methods that are discussed at length online. The key to using them is to adapt the frameworks to your business, e.g., hypotheses that aim to impact your growth levers are ranked higher than ones that don’t.

Step three: Test your hypothesis through experimentation

Without running an experiment it’s hard to know whether the changes you make impact your growth levers in the way you hypothesized. Too often businesses test ideas they are sure will work but discover through A/B testing that the results don’t support what they originally thought. This is why it’s so crucial to test, especially when you are changing aspects that relate to the core growth levers of your business.

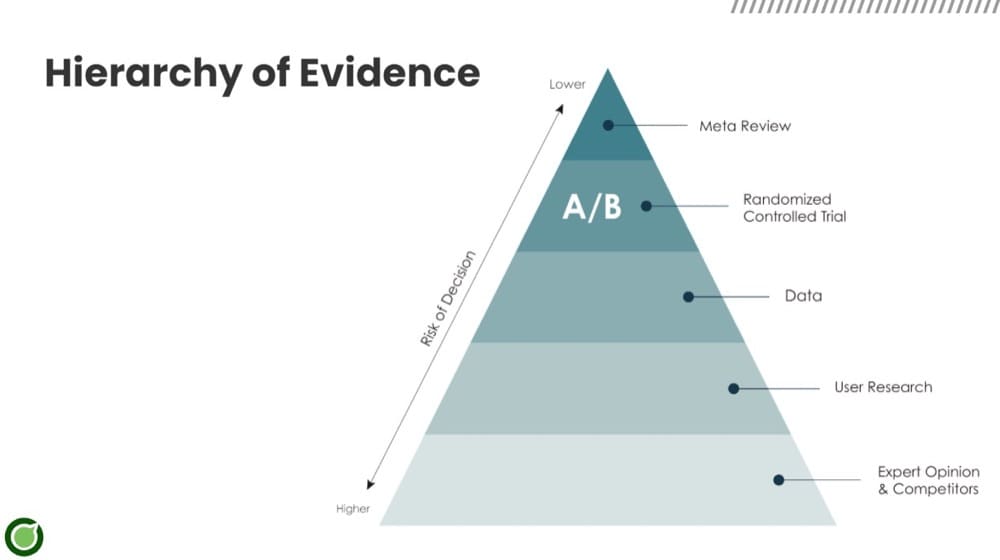

So where possible, guide decisions using A/B tests, which are highly reliable when determining which variant (or idea) performs best. This reliability only applies when A/B tests are run correctly.

To do so, you need to keep these statistical principles in mind:

- Minimal Detectable Effect (MDE)

- Sample size

- Statistical Significance

- Power

- Overall Evaluation Criterion (OEC)

- # of conversions

(The what and why of these concepts are here.)

Some businesses who are willing to accept more risk (e.g., that the results of an A/B test are a false positive or false negative) might adjust the level of scientific rigor involved.

Experimentation outside of A/B testing

Keep in mind that A/B testing is just one of many experimentation methods. Whatever the hypothesis, an experimentation method can likely be applied to help inform your decision. However, it might not always be cost-effective to do so.

Jim Manzi and Stefan Thomke wrote a great article detailing how to determine if it’s worth running an experiment for tricky-to-test ideas and how to design such experiments to maintain reliable results.

Understanding different testing methods available to you and the level at which results should be relied upon is vital for radical ideas which test business models or offline/back-of-house changes.

Ruben de Boer, Lead Conversion Optimization Manager at Online Dialogue, recently shared the hierarchy of evidence. This handy reference ranks methods used as evidence by the reliability of results. This hierarchy can be applied to experimentation and research methods.

Examples of growth lever experiments

To illustrate the above, I’ve curated some examples of experiments different businesses have run around their growth levers.

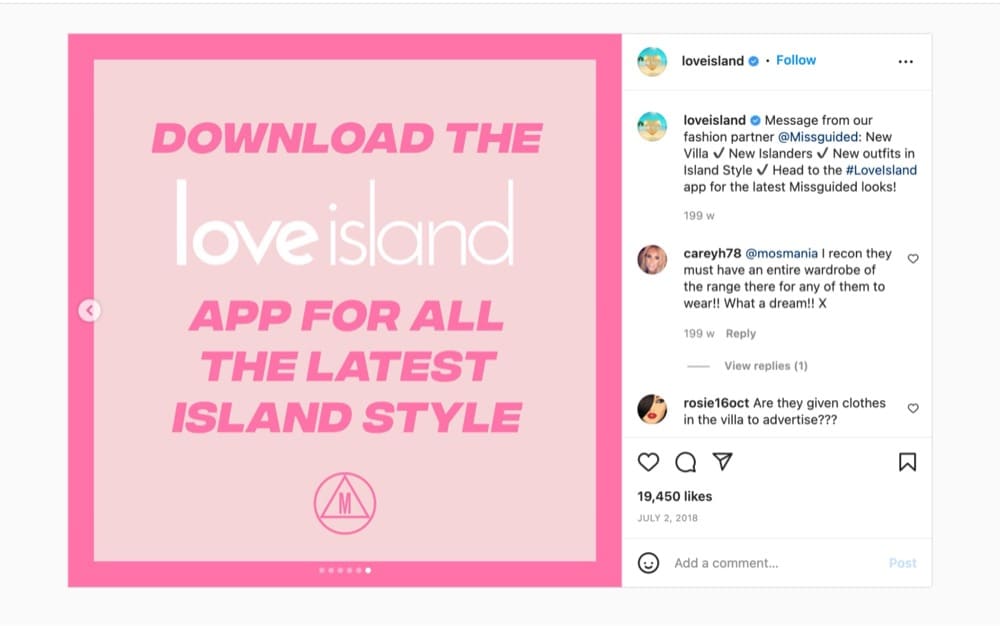

Customer acquisition growth lever test: Missguided experiments with partnerships to drive profit

Instagram was the primary awareness and acquisition channel for Missguided, but to lower CPA, they tested a brand partnership with the TV show Love Island.

Love Island already had an app, and as part of the partnership, viewers could shop for Missguided products via the Love Island app. As well as this, they trialed limited-time promotion codes that started when the show aired. Sales increased by 40% during the partnership, and profits increased by 532%.

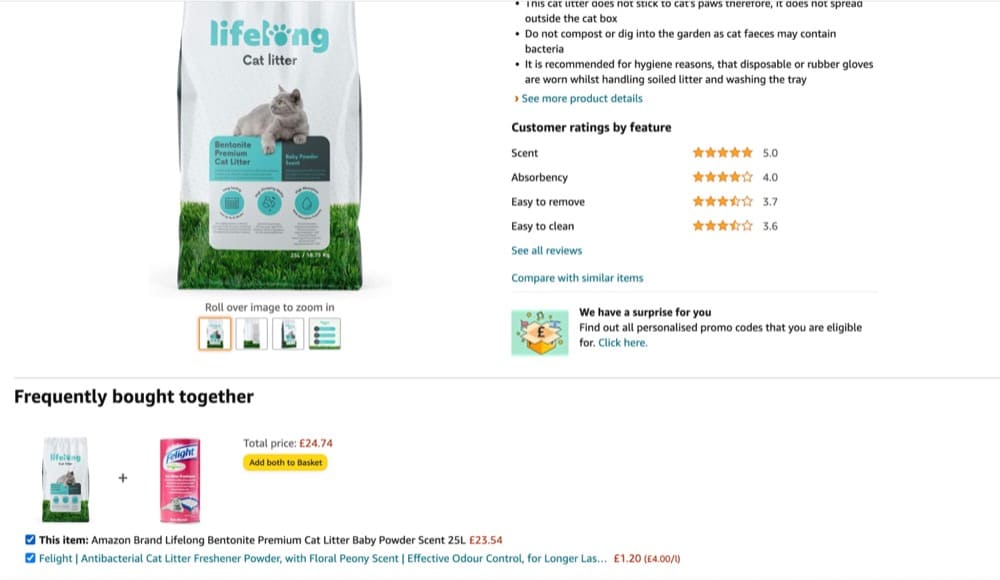

Customer value growth lever test: Amazon’s product bundle

While I don’t have experimentation results from this feature, you can bet Amazon tested its “frequently bought together” bundle options that appear on many product pages. It offers customers suitable products to purchase alongside their primary selection for a bundled price. In this case, cat litter and litter tray liners with a bundled price. In this case, cat litter and litter tray liners with a bundled price. When done well, bundles, upsells, and cross-sells are a great way to increase the profit from your customers.

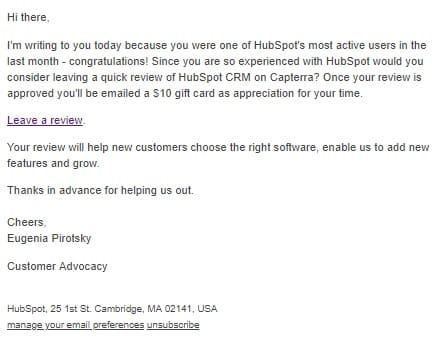

Customer retention growth lever test: HubSpot tests channels to drive customer reviews

HubSpot tested in-app notifications versus email notifications with a $10 incentive to see which method would increase the number of customer reviews.

HubSpot found that emails outperformed in-app notifications by 1.4x. From the emails, 24.9% of those who opened them left a review, compared to 10.3% of those who opened the in-app message.

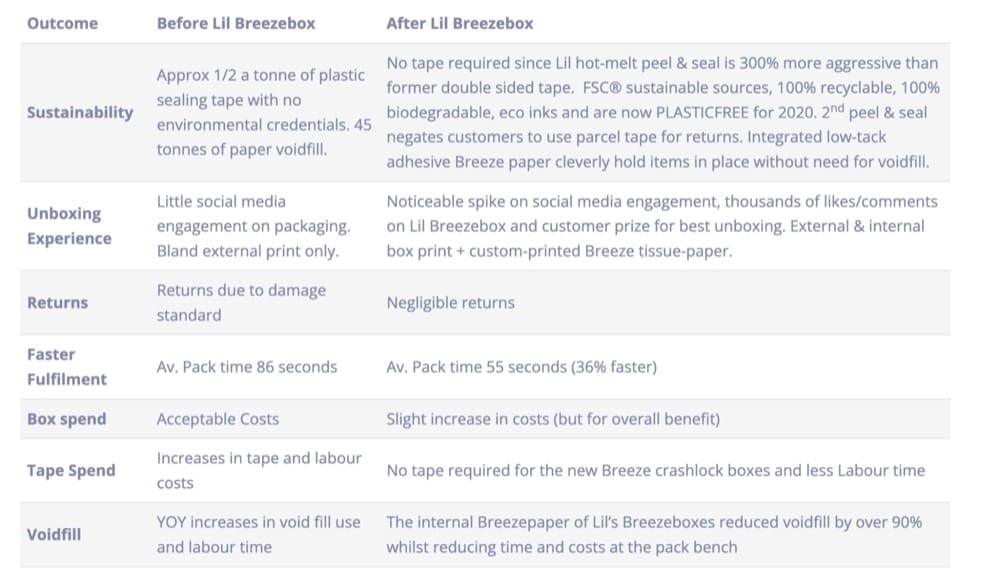

Cost optimization growth lever test: Beauty Bay packaging experiments

Beauty Bay iterated and experimented with new packaging options to select one which hit the right metrics for the business, from sustainability to unboxing experience.

While on this topic, it’s worth mentioning Pinky Promise, a Shopify app that helps ecommerce businesses experiment with varying delivery options. You can also use Convert Experiences to conduct these experiments, such as testing different delivery costs, timings, and methods with customers.

Step four: Rinse and repeat

You’re not going to make much impact if you get to this step only once. Growth needs repeatable and ongoing cycles of the process set out in this article. Therefore it’s essential to ensure the process of experimentation itself is also optimized.

Here are the core elements you need to run a successful experimentation process in your business:

- Ongoing user research and data analysis to develop hypotheses.

- A prioritization framework to help you surface the hypotheses likely to impact your growth levers the most. You only have so much resource, traffic, etc., so use them wisely.

- A QA process and agreed practices for running experiments and analyzing the results.

- A method of recording and sharing experimentation results with other teams.

- A process to move successful experiments to the right teams to implement.

- A way to measure the experimentation process itself to improve the growth machine. E.g., time from hypothesis to experiment or the number of successful experiments implemented.

Summary

The current ecommerce climate makes chasing revenue at any cost a fool’s errand. The new ecommerce growth playbook, which focuses on levers that drive profit, combined with a repeatable and continuous testing process to validate ideas scientifically, is the growth strategy modern ecommerce businesses have been seeking.

Follow the steps above to identify and scale your ecommerce business beyond one-off tweaking tests and costly acquisition campaigns and focus on the levers that will genuinely scale your business for the long term.

Written By

Katie Kelly

Edited By

Carmen Apostu