Experimentation in B2B Marketing Is Hell. Here’s How to Fix It

Experimentation in B2B marketing is much harder than in B2C, greatly because of the long sales cycle and its implications.

In this post, you will learn why experimentation is the key to good marketing, why it is such a challenge in B2B marketing, and how to implement an experimentation methodology and feedback loop to accommodate for that challenge.

Everyone has an opinion on whether marketing is an art or a science. But when it comes to experiments, there’s no debate – robust marketing experiments are the gold standard to establish causality, and should be down to a science for every marketing leader.

From your time in the high school chemistry lab, you may recall that experiments help test and prove (or disprove) a hypothesis – usually to do with a cause and effect relationship.

Experiments in marketing are no different. They help you identify the activities that are working (having the desired impact on a specific metric), eliminate those that are not, and if you are lucky, discover new strategies based on the insights gathered along the way.

In the era of disruption, they keep marketing at the cutting-edge – because what ‘works’ keeps changing. The only way to stay ahead is by finding and improving the activities that matter, and a structured approach to testing and experimentation canlead not just to improvements but also breakthroughs.

Sounds like a win-win so far.

So why, despite its obvious need and advantages, do B2B marketing leaders often avoid marketing experimentation?

The Challenge with B2B Marketing Experiments

While diverse buying committees (often 7 or more members involved in the purchase decision), and multi-channel buying journeys (tens, even hundreds of touchpoints) add to the complexity, the biggest challenge to experimentation for revenue-focused B2B marketers is the long sales cycle – the long gap between first contact and final conversion.

Here’s why.

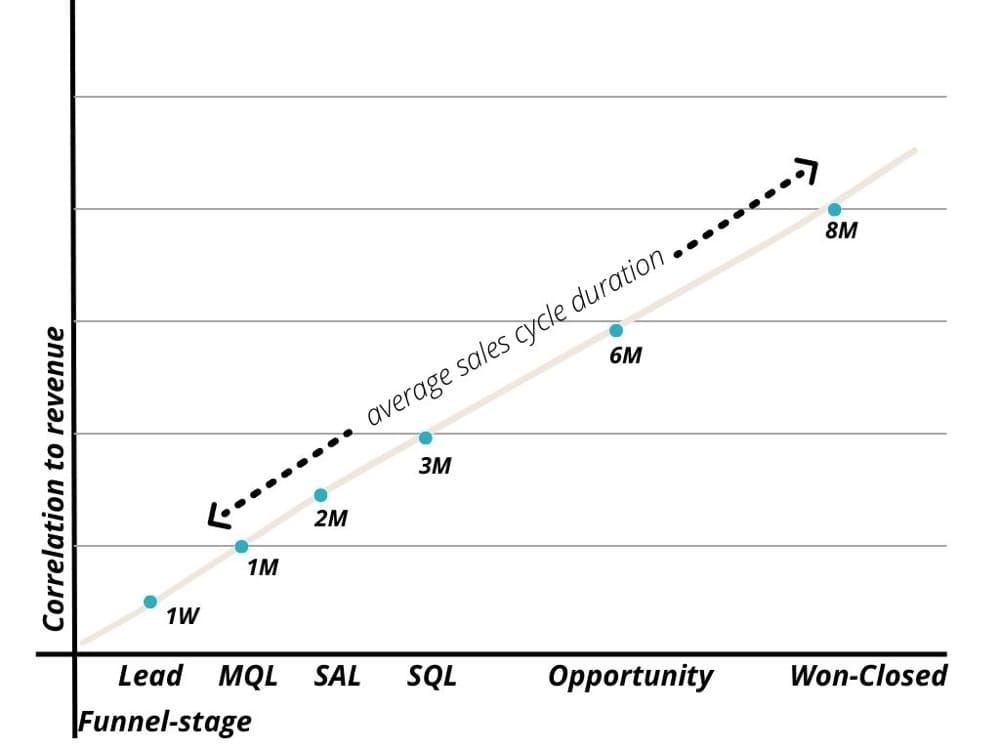

In a long sales cycle, the metrics most closely correlated to revenue are lower-funnel metrics. For example, opportunities (number of prospects who have gone through qualification and are likely to become customers), pipeline (the potential revenue of all the opportunities – meaning, the sum of all the expected revenue generated if all of the opportunities are won), sales cycle velocity (time taken to convert a lead into a paying customer), conversion rate (the ratio of leads that actually convert into paying customers).

Optimizing for such metrics can be challenging. An extended sales cycle means the impact of the experiment will only be tangible a long time after the activity is completed.

B2B marketers can’t afford to wait months to know if their activities are working or not. It might mean an entire lost sales cycle!

As a result, many marketers end up avoiding experimentation altogether, opting instead for shiny new tools, copying competitor strategies, or falling back on the use of ‘proxy metrics’ to measure revenue impact. The last may be popular, but if they are the only metric you measure, they may end up doing more harm than good to your revenue-focused experiments.

Why Proxy Metrics Are Not Enough For Revenue-Focused B2B Marketing Experiments

Proxy metrics are metrics that are not directly tied to generating revenue by themselves but can be used as indicators for the metrics that are.

In the B2B marketing context, we often see top funnel (ToFu) metrics such as lead gen, MQLs and SQLs being measured and optimized as a stand-in – or proxies – for the lower-funnel metrics.

This is because their impact is visible faster, they are relatively easier to track and measure, and can be optimized multiple times in one sales cycle.

However, it’s important to acknowledge that testing and experimenting with metrics that show ‘conversion’ from one funnel stage to the other is not the same as testing for metrics that show ‘real conversion’ – i.e. from prospect to paying customer.

Unfortunately, due to the more complex and lengthy sales cycle, the correlation of proxy metrics to lower-funnel metrics – the ones which can be directly tied to revenue – is much lower. That means proxy metrics can be indicative at best, unrelated at worst.

That is a real roadblock if you are trying to optimize for revenue. So while ToFu metrics have their place, they may not be the best proxy metrics for revenue-linked B2B experimentation.

This disconnect between funnel stage metrics and the length of the sales cycle presents a dilemma for the well-meaning marketing leader.

For example, as a SaaS business, you want to optimize for annual recurring revenue (ARR), a metric most closely related to your business revenue and indicative of overall business health.

With an average sales cycle of 8 to 12 months, that would mean waiting all year to figure out if your activities led to conversions that meet your ARR benchmark. Waiting that long will mean that you won’t be able to optimize anything this year.

However, if you go with a higher funnel proxy such as MQLs, you will be able to track and optimize to improve those metrics. Something is better than nothing right?

Unfortunately, at the end of the year, you find that though you did more of the activities that were driving MQLs, your MQL to Customer conversion rate dropped lower in the funnel. You now realize that you have optimized a proxy metric that wasn’t correlated with the revenue-linked conversion this whole time.

The B2B Marketers’ Dilemma

No doubt B2B marketers want to know (and show) the impact their activities are having on revenues.

But with actual revenues a good distance away from the marketing activities, and the most revenue-linked metrics firmly at the bottom of the funnel – or close to the end of the sales cycle – you have to make a choice.

That choice is between running more frequent optimization cycles using proxy metrics, or staying focused on revenue-linked metrics but running far fewer optimization cycles.

With the former, the feedback loop is faster, but the risk is you may optimize for metrics that don’t actually impact revenue. In other words, a wasted effort (and budget).

With the latter, you fear the feedback could be so slow that any optimization may come too late to make a difference. You might not even get the chance to redirect your marketing dollars to the most revenue-impacting activities in the same sales cycle.

Overcoming the B2B Experiment Challenge with the Revenue Marketing Methodology

Luckily, running marketing experiments doesn’t have to be an all-or-nothing choice. Not being able to run more frequent cycles is no reason to give up on experiments to optimize for revenue-tied metrics. There is a third alternative that is far more effective, and yes, scientific.

In fact, with this methodology, you don’t even have to choose. You just have to find the right balance.

A balance between optimizing for lower-funnel metrics and running the right number of optimization cycles. This means, you neither have to sacrifice the frequency of optimization cycles, nor your laser focus on end-funnel revenue metrics.

Here’s how it works.

Set Up the Right Conditions for B2B Marketing Experimentation

Being fully prepared to measure revenue metrics and make the most of your experimentation program has 3 non-negotiable components:

1. Align Goals with Revenues

Sales and marketing need complete alignment on each funnel stage metric, as well as which of those are the most important revenue-linked metrics for your business (and not just for each function). For example, if marketers chase traffic and leads, while sales care about SQLs and won-close, optimization of what truly matters becomes impossible.

As we saw, it is only too convenient to fall back on proxy metrics that are not directly linked to revenue. Creating a solid revenue model ensures all stakeholders are aligned around and oriented to lower-funnel metrics – the ones that most impact revenue outcomes.

In a recent interview, Guillaume “G” Cabane, former VP of Growth at Drift, Segment, and Mention, shares why the entire marketing team should align around revenue:

If you look at some of the work I’ve done these past years, what I’ve done is convert all of the marketing metrics into unified, forecasted revenue, metric dollar metric.

And that is very important and that informs the rest of my strategy. Otherwise, it’s hard to compare when you do. You drive traffic to some of your content. How valuable is that? Nope, hard to say. Now, somebody else is going to do a webinar. They have registered and participants. How valuable is that? […] And comparing those together is hard because you have different types of leads or engaged profiles of customers, at different steps of the funnel. And those, experiments have different amounts of time and budgets.

So it’s impossible to compare, unless you find a way to aggregate or simplify down that to a unique metric, that’s what I’ve done. And so by using some simple forecasting models, we convert all of the engagement metrics into future revenue. The future revenue has a multiplication of factors based on the likelihood for any given prospect based on their engagement, based on their size to convert at a future date at the future percentage and a future ACV.

And so my entire team looks only at future revenue. That helps us a lot decide what’s the roadmap. Where’s the highest lift to be had. And also, where is it most cost efficient?

It might be argued that Cabane is taking a rather extreme approach by only measuring revenue metrics. I believe that there is a wide range of effective metrics you can choose, as long as you understand the need to connect them back to revenue.

2. Set Up a Robust Attribution Solution

According to a recent survey, 76% of all marketers say they currently have or will have in the next 12 months, the capability to use marketing attribution. Great news, because being able to properly identify and measure the revenue impact of each marketing activity (channel, campaign, content, etc.) is a prerequisite to doubling down on the ones that are working.

Due to the complex nature of B2B customer journeys, not just any attribution solution will do. You need a full-funnel attribution solution capable of aggregating multiple online and offline marketing activities (channels, assets, touchpoints) through the funnel, and connecting attribution results to business results.

3. Know the Exact Length of Your Sales Cycle

The sales cycle length istypically the average time it takes to close a sale, as measured by the CRM system. The duration depends on the complexity of your sales process. It’s critical for all stakeholders to agree on and be aware of the exact sales cycle length because you will base your experimentation program on this value.

While there will always be pressure to show results fast, we are more interested in showing the right results – the ones that increase the revenue. That is why ignoring the sales cycle length as a key factor in experiments may lead you to either jump to premature conclusions, or make wrong decisions like cutting a marketing activity too soon or too late.

There seems to be a growing understanding in our industry that proper consideration of the length of the sales cycle should be taken into account.

Chris Walker, founder and CEO of Refine Labs, recently mentioned the importance of giving enough time for marketing initiatives to have an impact:

With a new marketing program in Enterprise SaaS, your time window to evaluate success should be 4-12 months. 4 months minimum.

It’s time to change this perception so Marketing teams get enough time/space to find new programs that actually drive business results.

Execute B2B Marketing Experimentation

Too many B2B marketers actually don’t consider optimization cycles when planning experiments, instead choosing metrics at random, isolated from the context of the larger funnel.

The revenue marketing methodology is better because it lets you measure as close to revenue as possible, without sacrificing the number of optimization cycles you need through the year. The full-funnel view also helps define and connect the cycles through the full duration of the sales cycle.

We call it finding the ‘optimization cycle sweet spot’ for your company.

Let’s take an example.

If your business has a longer sales cycle, and you are committed to optimizing for lower-funnel revenue-linked metrics, then it’s important to accept that the optimization cycle is just going to have to be longer in order to deliver conclusive results.

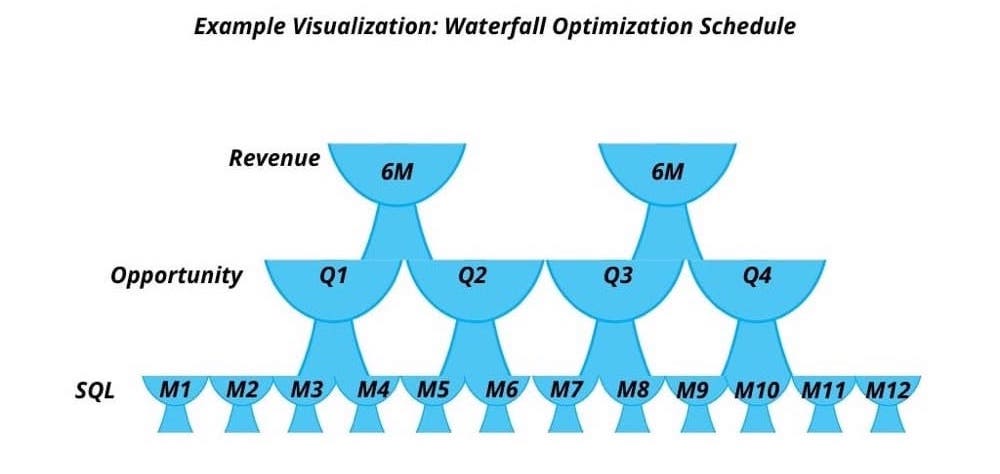

Let’s say you are optimizing for a metric such as revenue (closed-won), and you have a six-month sales cycle, there is no way to have a shorter optimization cycle than six months. So you plan two six-monthly cycles per year to analyze, measure, and optimize revenue with closed-won.

However, optimizing for revenue doesn’t mean you are doomed to two half-yearly optimization cycles! This is where you will design a custom cycle that cascades up the funnel based on your unique context.

Real-world B2B Example of Figuring out Optimization Cycles

In a recent interview we did about B2B marketing planning, Jason Widup, VP of marketing at Metadata, shared how he uses his demand model to stay on top of his KPIs and revenue targets every week.

It takes three months, six months, for us to understand the actual impact of a campaign or a new strategy. But, we’re always looking at leading indicators along the way there. Leading indicators are pipeline created, meetings booked, demo requests. So as long as we see these leading indicators are close… As we get closer to revenue, those conversion rates need to be tighter.

I look at [my demand model] once a week, probably. So I look at it in the current quarter, and I make sure it shows me a negative number, so I know I don’t need to drive more pipeline for the current quarter. I’m also looking at it twice a month for the next quarter, just to make sure the pipeline hasn’t shifted.

Widup uses his demand model to run scheduled optimization cycles, and track both revenue metrics and proxy metrics on a weekly and monthly basis. As is apparent from Widup’s answer, deciding when to set your optimization cycles also has to do with your own level of anxiety and personal preference and is not a decision that is solely logical and business-oriented.

Build Your Custom Waterfall Optimization Schedule

To accommodate for multiple duration optimization cycles based on your needs,build a waterfall optimization schedule, starting with the least frequent optimization cycle (e.g. six monthly or quarterly), and continue to the more frequent optimization cycles (e.g. monthly or weekly according to SQLs and MQLs).

In our example above, we started with a six-monthly optimization cycle for revenue (closed-won). For the next cycle, you pick the next closest revenue metric. Let’s say for your business, that is ‘opportunity’, and it takes 3 months from lead to opportunity. Then the next optimization cycle can be a quarterly one, for opportunity, which is also fairly correlated to revenue.

However, there is also pressure to show the management progress on a more frequent basis. So you take another, more frequent optimization cycle for the next removed metric. Let’s say ‘SQL’. You run a monthly analysis of SQLs. This can be a good proxy metric and a leading indicator that you are on the right track, but it does not replace the quarterly analysis.

It can even go as far as a weekly optimization cycle, say for ‘MQLs’. However, you should be aware of the exact correlation of these upper-funnel metrics to revenue – it will, most likely, be less correlated to revenue than the previous waterfall item.

Customize Your Optimization Cycle to Meet Your Priorities

It is important to note that each organization requires a different set of optimization cycles. You have to take into consideration variables such as length of the sales cycle, budget, chosen channels, ICP, tools, team capabilities, management priorities, etc. which are specific to your organization while designing your waterfall schedule.

Use Correlation Analysis as a Bonus

As we have seen, metrics that are not strongly correlated to revenue are not seen as a valid representation of success. Growth focused marketers have to challenge themselves to align around lower funnel metrics, since they are far more closely correlated with revenues than higher-funnel metrics.

However, there are two scenarios where you may need to use higher-funnel metrics as proxies, albeit after ascertaining their correlation to revenue – however remote – using correlation analysis.

These scenarios are

- In very long sales cycles, proxy metrics can help indicate progress or bottlenecks along the buying cycle. In such cases, the marketer can use upper-funnel metrics such as leads as a proxy metric, as long as they find some correlation of leads to revenue.

- There is a need to prove to the board or the C-Suite that even the upper-funnel metrics of the marketing activities are indeed correlated with revenue, even though the marketer is optimizing for lower-funnel metrics.

Since correlation analysis is outside the field of marketing and requires a data scientist or special software, these scenarios can be seen as a bonus to strengthen the experiment program.

Get Proactive with Pipeline Acceleration

Your optimization cycles are designed around existing sales cycle timelines, and mostly address effectiveness (volume) and cost-efficiency (ROI) metrics.

Alongside optimizing for those crucial metrics, you can also proactively implement a pipeline acceleration strategy to shorten the sales cycle and allow more testing cycles in your experiment program.

Accelerated pipelines mean shorter sales cycles. And shorter sales cycles mean faster feedback loops and shorter optimization cycles. Pipeline acceleration also brings revenue acceleration, a more simplified buyer journey, and less complexity.

Since we have already put a full-funnel attribution solution in place, we can more easily validate which channels contribute to shorter or longer sales cycles or impact the sales cycle tenure.

With that information, you can choose from many tactics to accelerate the pipeline, including identifying (and rationalizing) factors that contribute to a longer sales cycle, doubling down on sales enablement efforts, focusing on audience segments with faster sales cycles, and optimizing for channels with shorter sales cycles, among others.

Don’t Miss Out. Make the Power of B2B Marketing Experiments Work for You.

While B2B marketing experimentation is a challenge, not optimizing revenue-related metrics is no longer an option in the revenue era.

It is, however, important to stay realistic about the process: measuring the factors that impact a million-dollar deal that takes a year to close cannot be done in the same way as a $50 deal that takes 2 minutes to close.

While there is no magic formula to optimize for revenue-related metrics in long B2B sales cycles, the methodology we’ve shared can help you run a more cohesive and successful experiment program.

As revenue-focused marketers already using this methodology have discovered, by optimizing the right metrics in the context of the full funnel and sales cycle length, the payoff not only includes a clear connection between marketing activities and revenue, but also the confidence to put your dollars down behind the activities that are working through the funnel.

And with the methodology we’ve outlined for you in this article, nothing stops you from harnessing the power of B2B marketing experiments for your business.

Written By

Dan Carmel

Edited By

Carmen Apostu